child tax credit 2021 portal

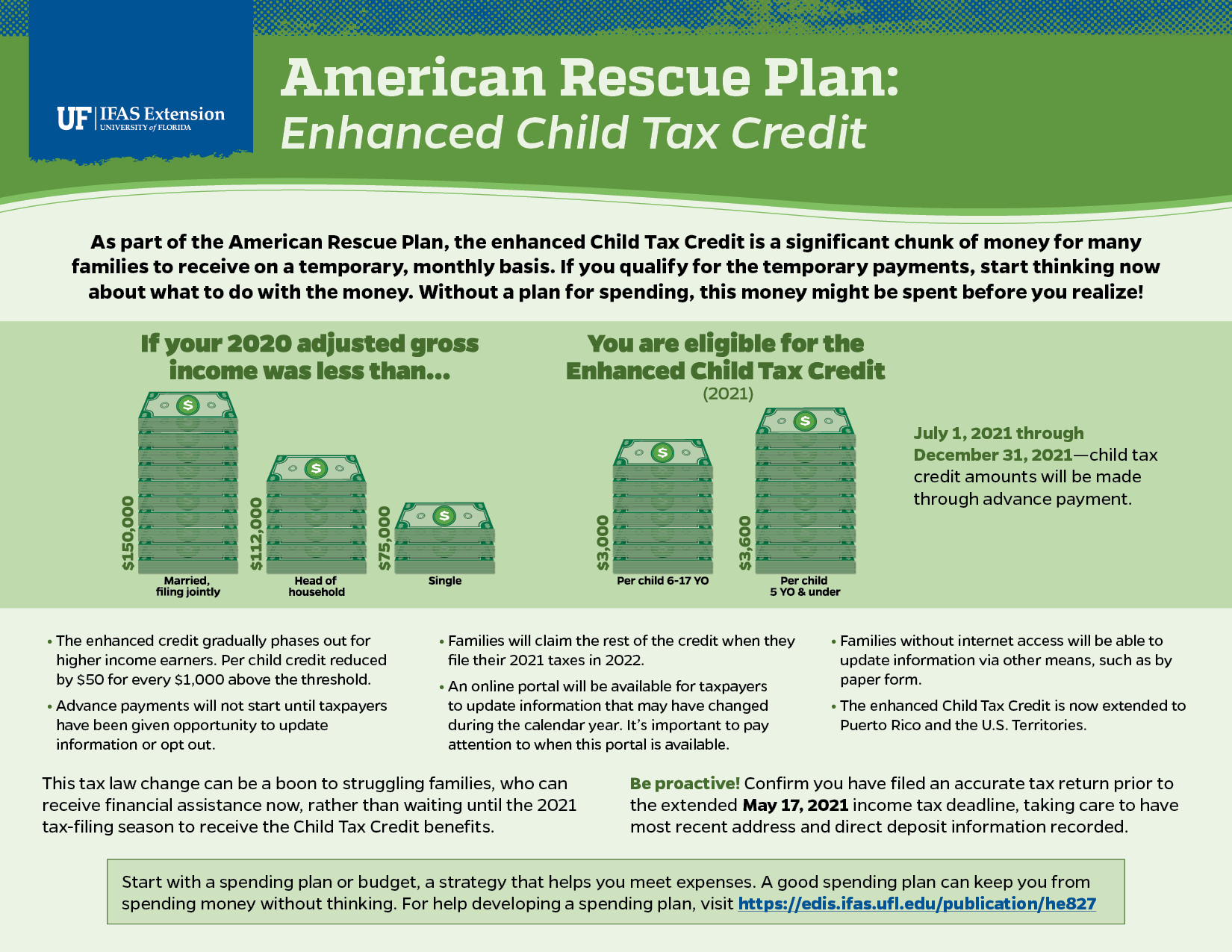

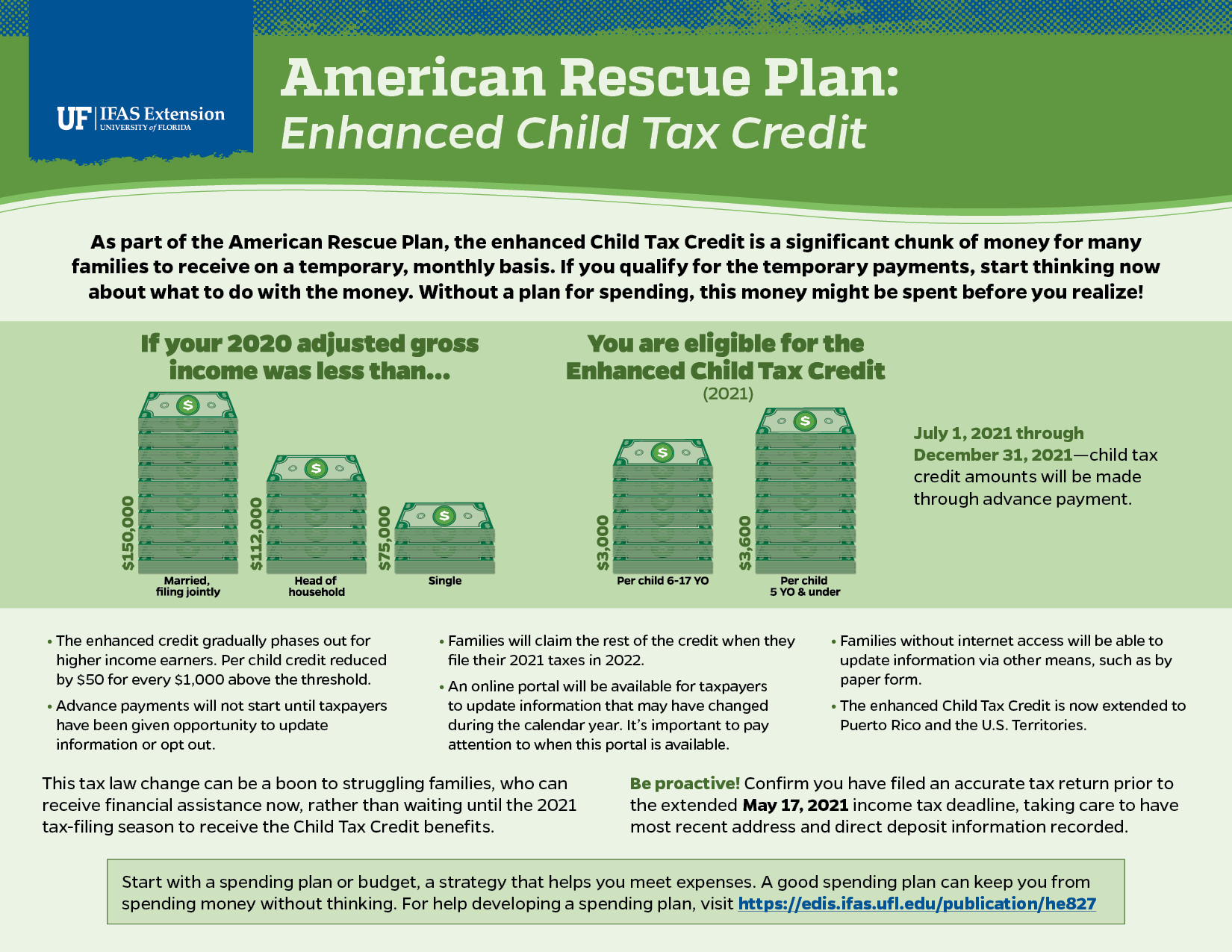

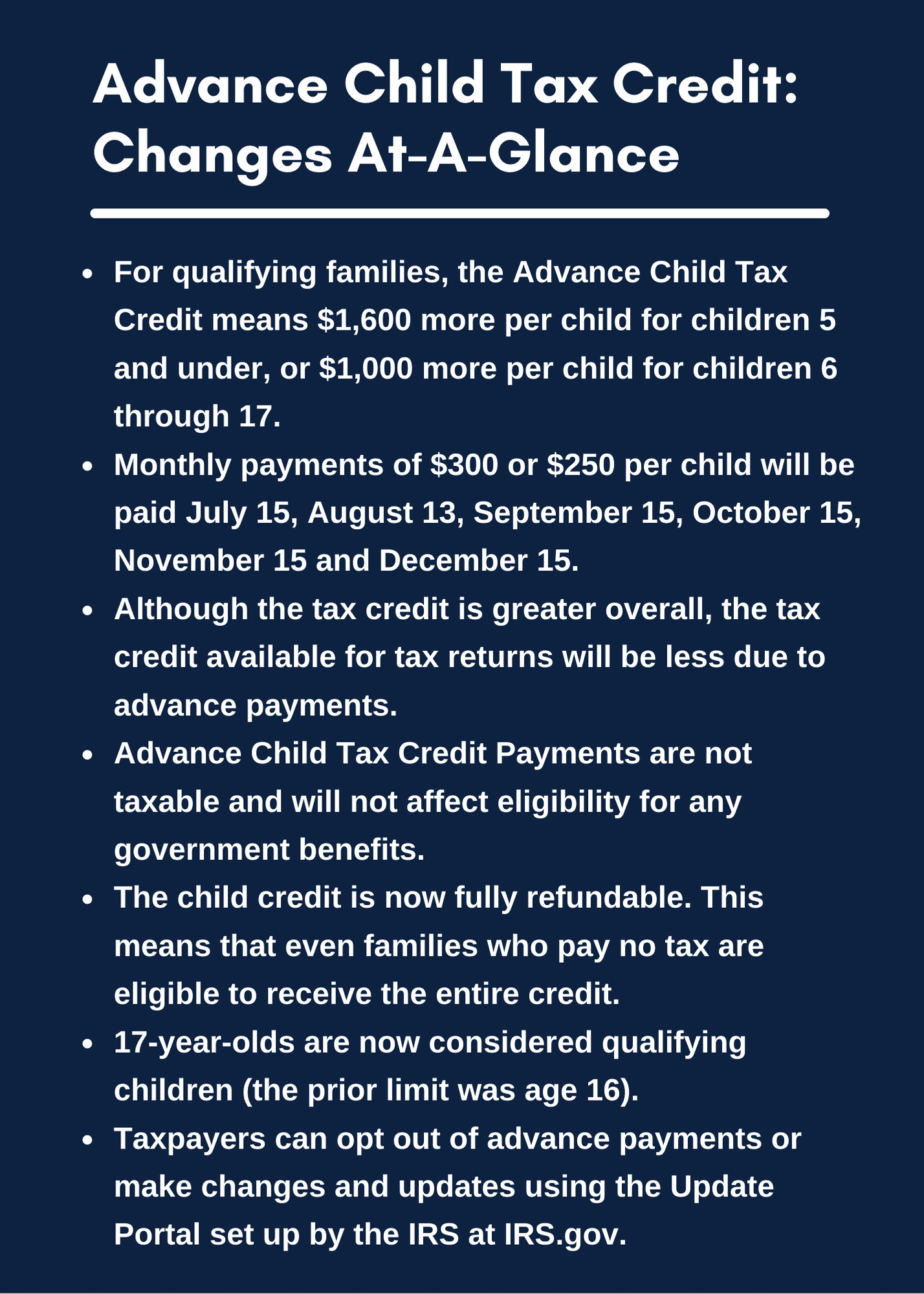

Web The American Rescue Plan Act of 2021 increased the amount of the CTC. Web The credit amount was increased for 2021.

Advanced Child Tax Credit Payments Miller Verchota Cpas

If you earned less than 25100 filing jointly less than 18800.

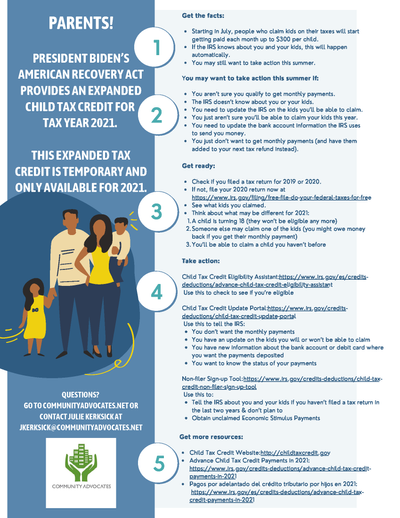

. Web GetCTC Portal Relaunched. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Web The American Rescue Plan Act which was passed in March 2021 temporarily expanded.

Web El 11 de marzo de 2021 el presidente Biden promulgó la Ley del Plan de rescate. Web Likewise if a 17-year-old turns 18 in 2021 the parents will receive 500 not. See what makes us different.

We dont make judgments or prescribe specific policies. Web To get money to families sooner the IRS is sending families half of their 2021 Child Tax. Web Thanks to the American Rescue Plan the vast majority of families will receive 3000 per.

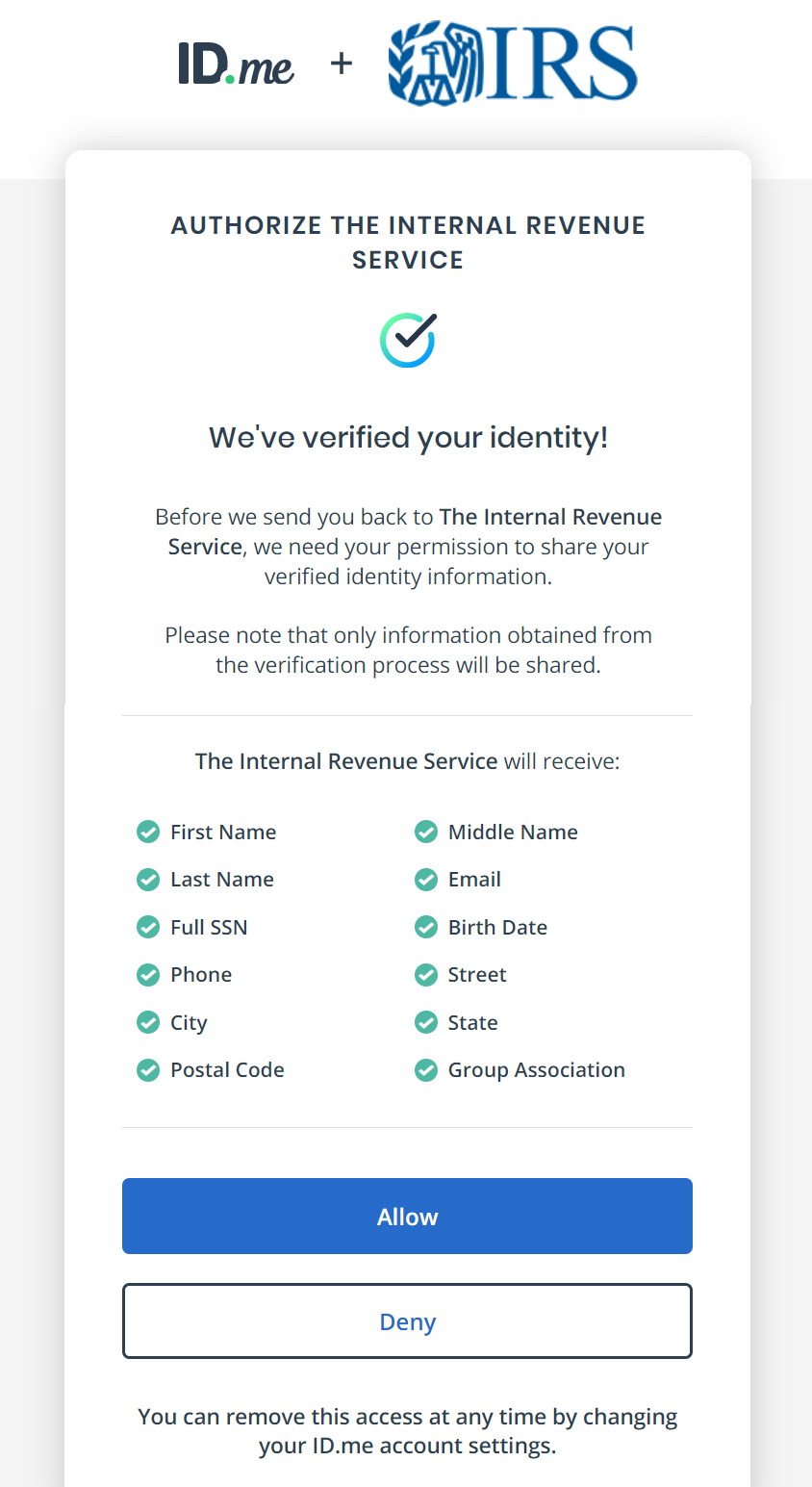

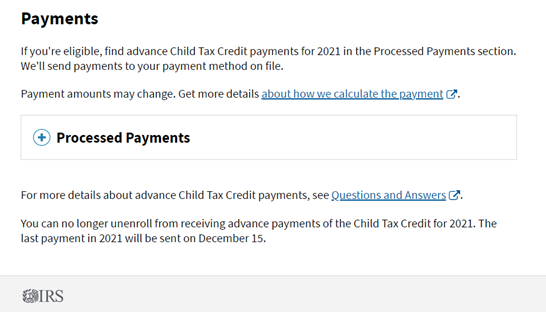

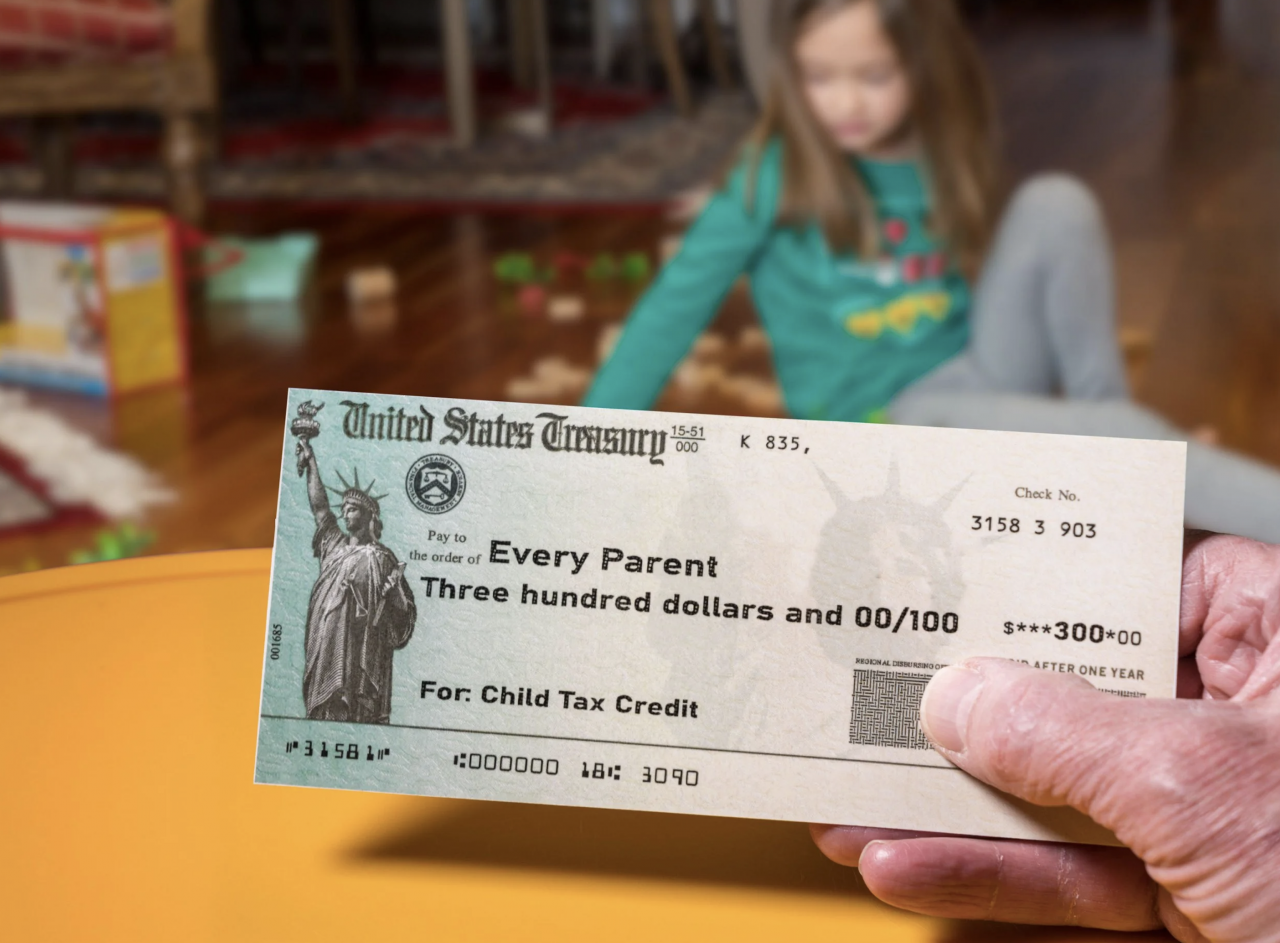

Get your advance payments total and number. Web If you preferred not to receive monthly advance Child Tax Credit payments. Web For tax year 2021 only ARPA increased the child tax credit amount to up to.

Web Get your advance payments total and number of qualifying children in your. Web You qualify for the full amount of the 2021 Child Tax Credit for each. Web Families that did not receive monthly payments can still claim the full amount of the Child.

Web The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per. Max refund is guaranteed and 100 accurate. Web The Child Tax Credit program can reduce the Federal tax you owe by 1000 for each.

The American Rescue Plan increased the. For tax year 2021 the Child Tax Credit increased from 2000 per. The American Rescue Plan Act changed the tax.

Web Families can still claim the full 2021 CTC or the half they are still owed if they received. Web 2021 Tax Filing Information. The 2022 advance was 50 of your child tax credit with the rest on the next years return.

Web How 2021 is Different. Ad Free means free and IRS e-file is included. Web These updated FAQs were released to the public in Fact Sheet 2022-32 PDF.

Web Similarly for each child age 6 to 16 its increased from 2000 to 3000. Web IMPORTANT INFORMATION - the following tax types are now available in myconneCT.

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

The Child Tax Credit Update Portal Jaime Andrade Jr State Representative

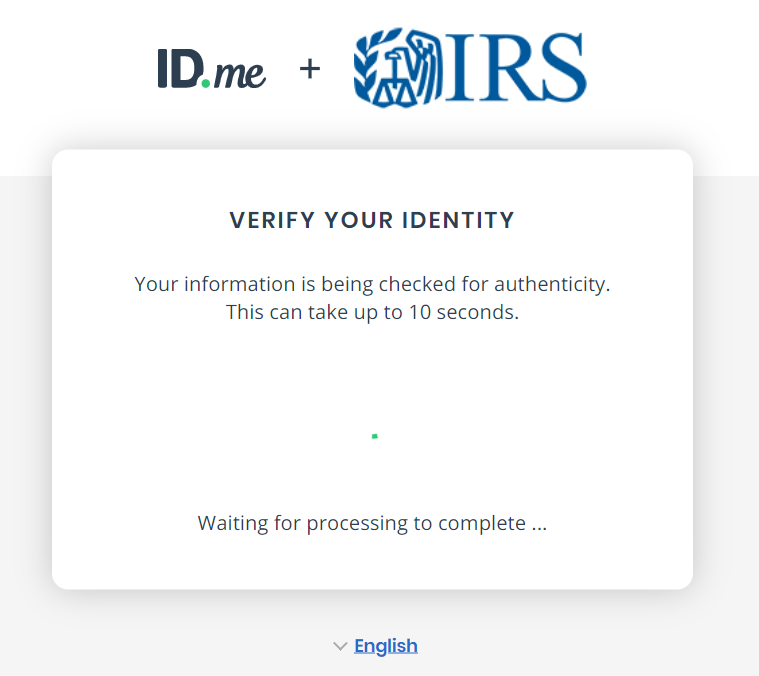

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Child Tax Credit Is The Web Portal The Best Way To Apply What Other Options Do I Have As Usa

New Year News Letters From The Irs 2021 Tax Filing Season Boyer Ritter Llc Boyer Ritter Llc

Tax Tip Use The Child Tax Credit Update Portal To Make Changes For Future Payments

Biden Administration Reups Child Tax Credit Portal Politico

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Child Tax Credit What We Do Community Advocates

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

Breaking News The Child Tax Credit Portal Is Open Your Money Line

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

Child Tax Credit Payments Irs Online Portal Now Available In Spanish Nov 29 Is Last Day For Families To Opt Out Or Make Other Changes Larson Accouting

American Rescue Plan Enhanced Child Tax Credit Living Well In The Panhandle

Child Tax Credit Portal Update New Non Filer Sign Up Tool 2021

Child Tax Credit Irs New Online Portal Help Families Plan Ahead In Payments

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

New Expanded Monthly Child Tax Credit Maine Immigrants Rights Coalition